Services

Real Estate

Services

Real Estate

Moving?

Let us help on your way

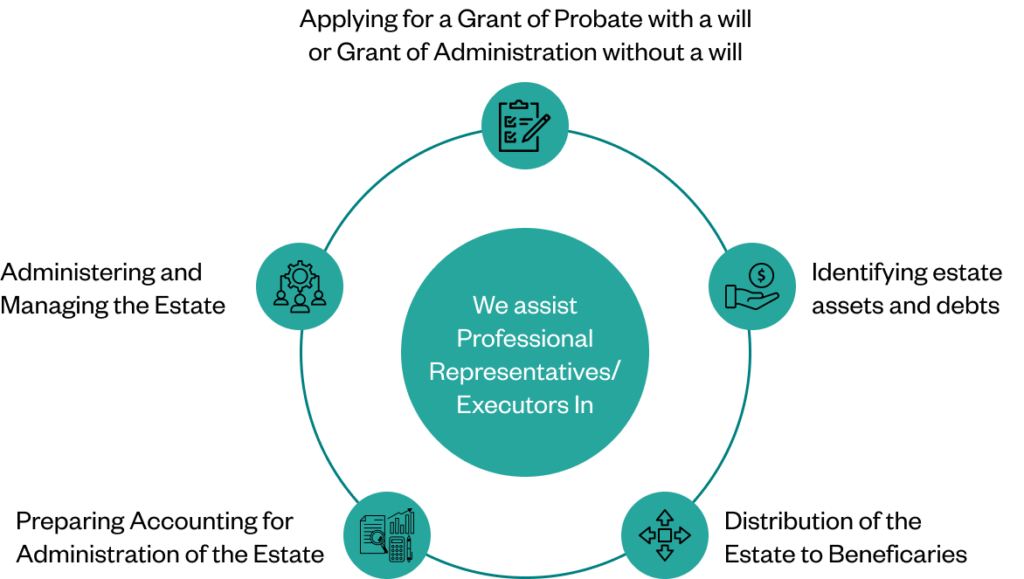

We assist Personal Representatives / Executors in

- Applying for a Grant of Probate (with a Will) or Grant of Administration (without a Will)

- Identifying estate assets and debts

Administering and Managing the Estate

Preparing Accounting for Administration of the Estate

Distribution of the Estate to Beneficiaries

Buying?

Getting Started

Buying?

Buying

Selling

Refinancing

Selling?

Getting Started

Buying?

Buying

Selling

Refinancing

Refinancing

Getting Started

Buying?

Buying

Selling

Refinancing

Getting Started

If you need help determining if your loved one’s estate needs to go through the probate process, please fill out a quick questionnaire and schedule a free 15-minute consultation to meet with our staff.

Schedule an Appointment

If you are ready to begin the probate process, please schedule a 60-minute Appointment.

Paid consultations are billed hourly and are credited towards our services.

We assist Personal Representatives /

Executors in

Frequently Asked Questions

Disbursements are the additional expenses incurred on behalf of the client by the law firm. This can include do diligent searches such as title searches, tax searches, PPR searches, courier cost, software cost, faxes, research etc.

If you are selling a condo, the cost of providing the estoppel or other condominium documents as set out in your contract to complete the transaction are not included in the flat rate fee

The report can be in the form of a separate letter or a stamp on the Real Property Report.

Money Lending and Estate Planning

Imagine this: a close family member hits a rough patch and needs financial help. Naturally, someone in the family, like a parent, steps in and loans the money with a handshake agreement that the money is to be repaid. But what if the parent passes away before the debt is settled? From my experience, this situation can quickly cause family conflict. The borrowing child may claim the parent intended the money to be a gift and it doesn’t need to be repaid. Meanwhile, other beneficiaries, usually the borrower’s siblings, argue it was a loan that should be deducted from the borrower’s inheritance. Failing to properly document loans or gifts may result in family strife, substantial legal costs, and ultimately a smaller inheritance for all beneficiaries of an estate. Clearly documenting any financial help in your will and specifying whether funds were loans or gifts will assist the executor of the estate in ensuring inheritances are distributed correctly and prevent resentment between siblings.

Will Review

Instead of Let us help you with our review service for TO Access our review service for

Estate / Trust Administration

If your loved one has recently passed away, we can assist you and your family with resolving their estate in order to distribute any inheritance with

Estate Planning

We provide our clients with comprehensive legal estate planning documents which includes