Services

Estate Trust/

Administration

Services

Estate Trust/

Administration

Practical and Compassionate Estate Administration Guidance

After the passing of a loved one, there are often many questions about how to distribute the property, money, and belongings left behind. Where to begin is often overwhelming. Our experienced estate lawyers provide practical knowledge and easy to follow guidance in the administration of an estate.

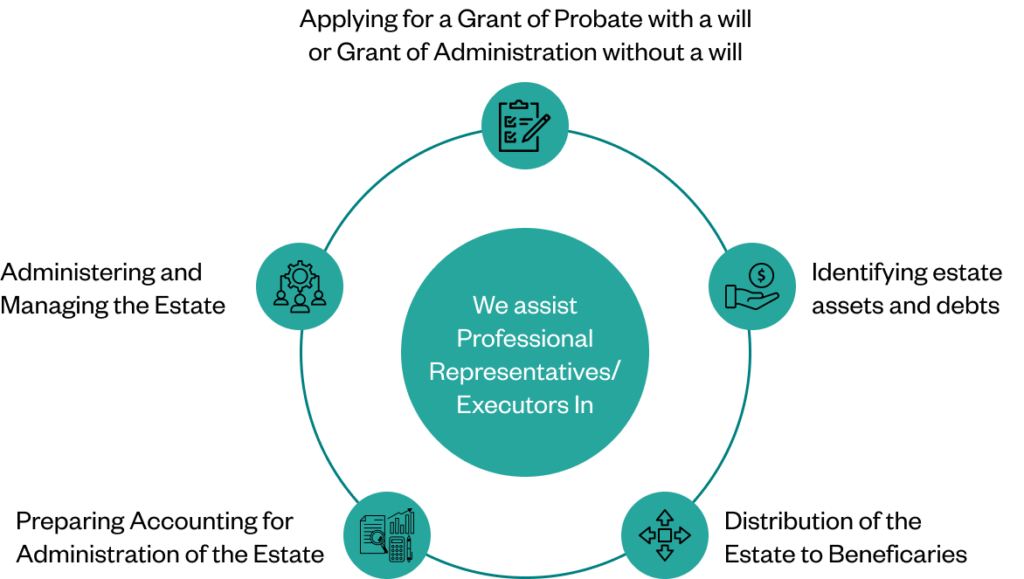

We assist Personal Representatives / Executors in

Frequently Asked Questions

Generally, a Will is submitted for probate in Alberta if :

- there assets that do not transfer upon death,

- real estate registered in the deceased’s name,

- there is a large sum of money in a bank account or investment account

- validity of will is in question

- assets are transferred to the estate

- corporate assets that are not dealt with by USA

If you’re unsure whether you need to probate the will, consulting with an experience estate lawyer will help guide you.

They can review the will with you, identify any potential issues, and determine which assets require probate. Your lawyer’s knowledge will guide you through the process, ensuring that everything is handled correctly and efficiently.

Applying for a Grant of Probate can be a complex process.

Probate is the process where a court application is made to prove a Will so the executor / personal representative has court appointed authority to carry out their duties.

Money Lending and Estate Planning

Imagine this: a close family member hits a rough patch and needs financial help. Naturally, someone in the family, like a parent, steps in and loans the money with a handshake agreement that the money is to be repaid. But what if the parent passes away before the debt is settled? From my experience, this situation can quickly cause family conflict. The borrowing child may claim the parent intended the money to be a gift and it doesn’t need to be repaid. Meanwhile, other beneficiaries, usually the borrower’s siblings, argue it was a loan that should be deducted from the borrower’s inheritance. Failing to properly document loans or gifts may result in family strife, substantial legal costs, and ultimately a smaller inheritance for all beneficiaries of an estate. Clearly documenting any financial help in your will and specifying whether funds were loans or gifts will assist the executor of the estate in ensuring inheritances are distributed correctly and prevent resentment between siblings.

Will Review

Instead of Let us help you with our review service for TO Access our review service for

Estate / Trust Administration

If your loved one has recently passed away, we can assist you and your family with resolving their estate in order to distribute any inheritance with

Estate Planning

We provide our clients with comprehensive legal estate planning documents which includes

Getting Started

If you need help determining if your loved one’s estate needs to go through the probate process, please fill out a quick questionnaire and schedule a free 15-minute consultation to meet with our staff.

Getting Started

If you need help determining if your loved one’s estate needs to go through the probate process, please fill out a quick questionnaire and schedule a free 15-minute consultation to meet with our staff.

Schedule an Appointment

If you are ready to begin the probate process, please schedule a 60-minute Appointment.

Paid consultations are billed hourly and are credited towards our services.